[Rewritten on July 5, 2025 after the new 2025 Trump tax law was passed.]

Because I’m self-employed and I’m under 65, I buy health insurance from a health insurance marketplace established under the Affordable Care Act (ACA). Every state has one. Some states run their own. Some states use the federal healthcare.gov platform. It’s for the self-employed, early retirees, and others who don’t get health insurance through an employer or a government program such as Medicaid or Medicare.

You may get a Premium Tax Credit (PTC) when you buy health insurance from an ACA marketplace. How much tax credit you get is based on your modified adjusted gross income (MAGI) relative to the Federal Poverty Level (FPL) for your household size. In general, the lower your MAGI is, the less you pay for health insurance net of the tax credit.

Your MAGI for ACA is basically:

Wages, 1099 income, rental income, interest, dividends, capital gains, pension, withdrawals from pre-tax traditional 401k and IRAs, and Roth conversions all go into the MAGI for ACA. Muni bond interest and untaxed Social Security benefits also count in the MAGI for ACA.

Tax-free withdrawals from Roth accounts don’t increase your MAGI for ACA.

Side note: There are many different definitions of MAGI for different purposes. These different MAGIs include and exclude different components. We’re only talking about the MAGI for ACA here.

Your premium tax credit goes down as your MAGI increases. Up through the year 2020, the tax credit dropped to zero when your MAGI went above 400% of the Federal Poverty Level (FPL). If your MAGI was $1 above 400% of FPL, you would pay the full premium with zero tax credit.

Laws changed during COVID. This cliff became a slope for five years, from 2021 to 2025. The tax credit continued to drop as your MAGI increased, but it didn’t suddenly drop to zero when your income went $1 over the cliff.

Removing the cliff was a huge relief to people with an income higher than 400% of FPL ($81,760 in 2025 for a two-person household in the lower 48 states). The tax credit also became more generous during those five years at income levels below the cliff.

The new 2025 Trump tax law — One Big Beautiful Bill Act — didn’t extend the slope treatment or the enhanced tax credit after 2025. The 400% FPL cliff is scheduled to return in 2026. The premium tax credit will also drop back to pre-COVID levels at incomes below 400% of FPL.

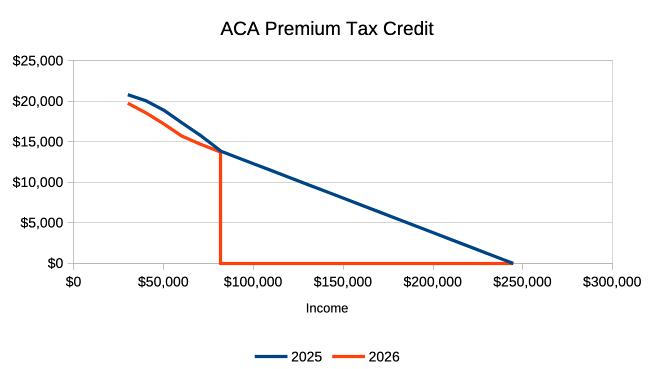

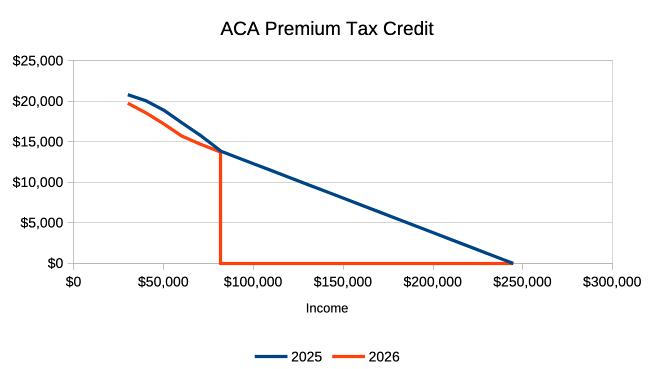

The chart above shows the ACA premium tax credit at different incomes for a sample household of two 55-year-olds in the lower 48 states. The blue line is for 2025, with the slope and the enhanced tax credit. The red line is for 2026, without the enhanced tax credit. The sharp vertical drop is the cliff.

How your premium tax credit will change in 2026 depends on where you are in the chart.

If your income is to the left of the cliff in the chart, your tax credit will drop slightly. It goes down from $18,900 to $17,200 at $50k income in this example. A $1,700 drop in the tax credit translates to an increase of about $140/month for health insurance.

If your income is to the far right in the chart, your tax credit will also drop, but you have the income to afford it. At $200,000 income in this example, the tax credit drops from $3,800 to $0, raising the cost for health insurance by a little over $300/month.

The drop is precipitous immediately to the right of the cliff. We’re talking about receiving over $13,000 in tax credit in 2025 versus $0 in 2026 for a two-person household with an income of $85k. How do you come up with an extra $13,000 for health insurance when your income is $85k?

The data for my example came from a calculator created by KFF. You can enter your specific zip code, household size, and age in this calculator to estimate how much your premium tax credit and your net health insurance premium will change.

The chart I used as an example is for a two-person household. You also have a chart like this. The difference is where your red line drops to the X-axis. You must know first and foremost where the cliff is. The table below shows the 400% FPL cliff for different household sizes in 2026.

| Household Size | Lower 48 States | Alaska | Hawaii |

|---|---|---|---|

| 1 | $62,600 | $78,200 | $71,960 |

| 2 | $84,600 | $105,720 | $97,280 |

| 3 | $106,600 | $133,240 | $122,600 |

| 4 | $128,600 | $160,760 | $147,920 |

| 5 | $150,600 | $188,280 | $173,240 |

| 6 | $172,600 | $215,800 | $198,560 |

| 7 | $194,600 | $243,320 | $223,880 |

| 8 | $216,600 | $270,840 | $249,200 |

Source: Federal Poverty Levels (FPL) For Affordable Care Act.

If your income is close to the cliff, you should manage it carefully to keep it from going over the cliff.

The most critical part is to project your income throughout the year and not to realize income willy-nilly before you do the projection. You can still adjust if you find your income is about to go over the cliff before you realize income. Many people are caught by surprise only when they do their taxes the following year. Your options are much more limited after the year is over.

If income from working will push your MAGI over the cliff, maybe work a little less to keep it under.

Tax-free withdrawals from Roth accounts don’t count as income.

Take a look at the MAGI definition. Minimize anything that raises your MAGI, and maximize everything that lowers your MAGI.

When you have self-employment income, you have the option to contribute to a pre-tax traditional 401k and IRA. Those pre-tax contributions lower your MAGI, which helps you stay under the 400% FPL cliff.

Choose a high-deductible plan and contribute the maximum to an HSA. The new 2025 Trump tax law made all Bronze plans from an ACA marketplace HSA-eligible starting in 2026.

On the other hand, Roth conversions, withdrawals from pre-tax accounts, and realizing capital gains increase your MAGI. You should be careful with doing those when you’re trying to stay under the 400% FPL cliff.

If you’re at risk of going over the cliff in 2026, consider accelerating some income to 2025 when the premium tax credit is still on a slope. If pulling income forward to 2025 helps you stay under the cliff in 2026, you lose much less in premium tax credit from your additional income in 2025 than the steep drop in 2026.

If your need for more cash is only temporary, consider borrowing instead of withdrawing from pre-tax accounts or realizing large capital gains. Spending borrowed money doesn’t count as income.

Instead of selling stocks and pushing yourself over the cliff by the realized capital gains when you buy a new car, take a low-APR car loan to stretch it out. HELOC and security-based lending are also good sources for borrowing.

You can repay the loan when you don’t need as much cash or when you no longer use ACA health insurance.

If you can’t avoid going over the 400% FPL cliff, consider income bunching. When you’re already over the cliff, you might as well go over big. Withdraw more from pre-tax accounts or realize more capital gains and bank the money for future years.

Spending the banked money doesn’t count as income. Going over the cliff big time in one year may help you avoid going over again for multiple years.

There is another cliff on the low side, although that one is easily overcome if you have pre-tax retirement accounts.

To qualify for a premium subsidy for buying health insurance from the ACA exchange, you must have income above 100% of FPL. In states that expanded Medicaid, you must have your MAGI above 138% of FPL. This map from KFF shows which states expanded Medicaid and which states did not.

The minimum income requirement is checked only at the time of enrollment. Once you get in, you’re not punished if your income unexpectedly ends up below 100% or 138% of FPL. The new 2025 Trump tax law added requirements to Medicaid for reporting work and community engagement. You don’t want to have your income fall below 100% or 138% of FPL and be subject to those reporting requirements in Medicaid.

If you see your income is at risk of falling below 100% or 138% FPL, convert some money from your Traditional 401k or Traditional IRA to Roth. That’ll raise your income above 100% or 138% of FPL.

If you are paying an advisor a percentage of your assets, you are paying 5-10x too much. Learn how to find an independent advisor, pay for advice, and only the advice.

Copyright © 2019-2024 Buzzlenss All rights reserved. About Us | Contact Us | Disclaimer | Terms Of Use | Privacy Policy